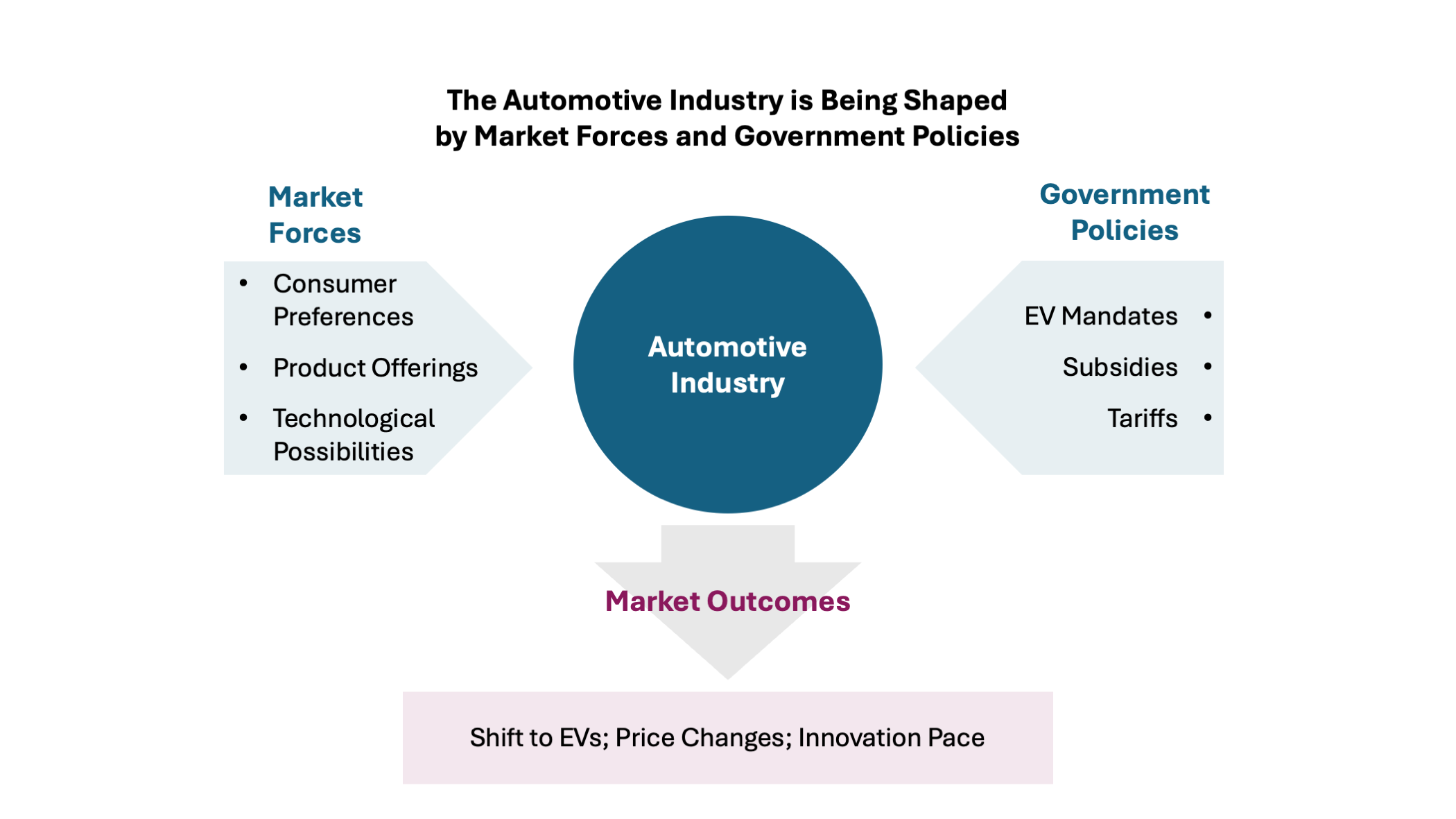

In today’s economy, consumer choices have traditionally played a dominant role in determining which companies, products, and services succeed. However, government policies are now exerting greater influence over industries and market outcomes. This shift is particularly evident in the automotive industry, which is currently undergoing significant transformation. Emerging technologies and regulatory mandates are challenging long-established players and reshaping the global value chain.

This could be an opportunity for Saudi Arabia to position itself as a key regional and global player in the automotive value chain. Automotive is one of the strategic sectors that the kingdom is targeting in pursuing its economic diversification agenda.

EV Mandates and Market Reality

The tension between market forces and government mandates is clearly evident in the electric vehicle (EV) policies being adopted by several countries to phase out internal combustion engine (ICE) vehicles. The European Commission is targeting ending the sale of ICE vehicle by 2035, while the UK has implemented a policy requiring 80% of new cars and 70% of new vans sold to be zero-emission by 2030, increasing to 100% by 2035. In the United States, the Biden administration has targeted 50% of all car sales to be Electric by 20301.

To facilitate this transition, governments are offering substantial incentives to both producers and consumers. In the United States, the Internal Revenue Service (IRS) provides car buyers with a tax credit of up to $7,500 for EV purchases made between 2023 and 20322. Similarly, Japan has introduced a 10-year tax reduction for automakers to accelerate the production of electrified vehicles, including EVs and plug-in hybrid electric vehicles (PHEVs). Under this program, the government offers subsidies of up to 850,000 yen (approximately $5,600) for EVs and 550,000 yen (around $3,600) for PHEVs, aiming to ensure that all new passenger vehicle sales are electrified by 20353.

However, the transition to electric vehicles (EVs) is facing considerable headwinds. Consumer demand remains weak, largely due to concerns over high prices, reliability, and limited driving range. Reflecting these challenges, Stellantis—parent company of brands such as Jeep, Chrysler, and Fiat—reported a 20% decline in vehicle deliveries in the third quarter of 20244. These issues are leading automakers to reconsider their EV production plans. Ford, for instance, has delayed production of its flagship electric F-150 Lightning by several weeks and has scaled back shifts at its Detroit plant.5

In light of this market reality, growing voices within the industry have called for a revision of the set EV targets. BMW Chief Executive Officer, Oliver Zipse, has stated at Paris Automotive Summit in October that the European Union’s plans “are no longer realistic”, warning that the existing mandate will lead to a “Massive shrinking” of Europe’s automotive industry6. Similarly, a group of UK automotive leaders have written a letter to the Chancellor of the Exchequer warning that the “EV market looks set to miss its target”, and that current mandate is putting tremendous pressure on the industry7.

Intensifying Global Competition and the Rise of Protectionist Policies

The challenging market conditions have been further intensified by the rapid ascent of China’s electric vehicle (EV) companies. In a significant shift last year, China surpassed Japan to become the world’s largest exporter of new cars8, driven by its manufacturers’ efforts to diversify beyond a saturated domestic market. Leading Chinese EV makers, such as BYD, Nio, and Chery, are now producing advanced electric vehicles at costs approximately 30% lower than those of European automakers, as noted by Carlos Tavares, CEO of Stellantis9. Beyond cost advantages, Chinese EVs also feature cutting-edge technologies, making them highly competitive in the global market.

The threat to long-established automakers has now penetrated their domestic markets. For the first time in its 87-year history, Volkswagen is considering the closure of three factories in Germany and a 10% reduction in its workforce. Similarly, Stellantis, which owns brands like Opel, Fiat, and Peugeot, is under increasing pressure from workers’ unions and politicians to keep its Turin plant operational despite declining sales. Meanwhile, assembly lines in France are being relocated to lower-cost regions such as Morocco and Turkey8.

This development has prompted governments in Europe and the United States to adopt protectionist measures aimed at safeguarding their domestic automotive industries. Earlier this year, the United States announced 100% tariffs on Chinese EV imports. The European Commission followed suit by announcing duties on imported EVs built in China of up to 45%. The EU commission took this step following an investigation that found that China has “benefits from unfair subsidization” that is causing a “threat of economic injury to EU BEV producers”10.

However, many automakers, while acknowledging this challenge, are advising governments against taking a protectionist stance. These measures, automakers suggest, might trigger a retaliation from China, one of the biggest car markets. Instead, they called for greater investment in charging infrastructure and better financial incentives for electric vehicles.

Saudi Arabia Joining the Automotive Race

The evolving global automotive market presents a valuable opportunity for Saudi Arabia to establish itself as a key player in the international automotive value chain. As one of the twelve strategic sectors outlined in the Kingdom’s National Industrial Strategy, the automotive industry plays a crucial role in advancing Saudi Arabia’s economic diversification goals under Vision 2030.

Significant progress has already been made toward developing a local automotive industry in Saudi Arabia. The Public Investment Fund (PIF) launched CEER, the Kingdom’s first automotive brand, in partnership with China’s Hon Hai Precision Industry Co. (Foxconn). CEER aims to design, manufacture, and market a cutting-edge range of electric vehicles (EVs), focusing on e-mobility, connectivity, and autonomous driving technologies. In a similar effort, PIF and Hyundai Motor Company have signed a joint venture agreement to establish a manufacturing facility in Saudi Arabia for both internal combustion engine (ICE) vehicles and EVs, with an investment exceeding $500 million11.

Efforts to develop local talent are also underway as part of Saudi Arabia’s initiative to localize the automotive industry. This October, the National Automotive and Vehicles Academy (NAVA) celebrated its inaugural cohort of 210 students, chosen from over 28,000 applicants12. Located in King Abdullah Economic City (KAEC), the academy was established in collaboration with key partners, including the National Industrial Development and Logistics Program (NIDLP), the Human Resources Development Fund (HRDF), CEER, and Lucid Motors, in which PIF holds a majority stake.

Saudi Arabia boasts the largest automotive market in the Middle East, with approximately 730,000 cars sold in 2023. Supported by an influx of expatriates and the rising number of women drivers—who accounted for 30% of car purchases in 2023—vehicle sales are projected to reach 870,000 this year13. However, EV sales remain limited, with market penetration at under 1%, compared to roughly 3% in the UAE, nearly 10% in Europe, and around 22% in China14. Nevertheless, Saudi Arabia is committed to increasing EV penetration to 30% by 2030 as part of its broader pledge to achieve net-zero emissions by 206015.

A Future Shaped by Policies

The current landscape highlights the growing importance of government policies in shaping the future of the automotive industry. Forecasting the industry’s trajectory requires close monitoring of governmental policies and strategic initiatives. Several critical factors will ultimately determine the extent of these policies’ influence on the industry’s development.

EV Mandates

A debate is emerging over the feasibility of current EV mandates, as ambitious targets could impose substantial costs on automotive companies and disrupt the sector. As a result, many industry experts and leaders are urging the government to consider extending timelines, allowing the industry more time to innovate, develop, and adapt effectively.

Protectionist Policies and the Reshaping of Global Supply Chain

The intensifying tariff wars and the rise of protectionist policies are reshaping the global economy. As more countries turn to measures outside the framework of the World Trade Organization (WTO), we are likely to see a more fragmented global economy dominated by bilateral and multilateral agreements. Trade blocs that succeed in integrating their automotive supply chains will be well-positioned to compete on the global stage.

Government Subsidies and Industrial Strategies

Subsidies and tariffs have been the primary tools used by governments to bolster their domestic automotive industries. However, to build a truly competitive automotive sector, a broader set of policies should be considered. Strategic initiatives such as developing robust infrastructure—rails, highways, and ports—and the provision of key services like specialized workforce training and affordable energy can be equally powerful in fostering growth and resilience in the automotive sector. These complementary measures enhance the industry’s long-term competitiveness and development.

Research and Innovation

The success of Chinese automakers is driven not only by competitive pricing but also by their advanced technological capabilities. China has made significant strides in EV technology, battery innovation, and software development, surpassing many legacy automakers. To remain competitive in this evolving automotive landscape, continuous investment in research and development is essential. Additionally, strategic partnerships have become pivotal for technology sharing and knowledge exchange. For example, Volkswagen has teamed up with Chinese startup Xpeng to accelerate the development of affordable EVs, while Renault has collaborated with Geely to enhance combustion engine technology. These alliances underscore the industry’s shift toward collaborative innovation as a pathway to progress.8.

References:

- https://www.whitehouse.gov/briefing-room/statements-releases/2021/08/05/fact-sheet-president-biden-announces-steps-to-drive-american-leadership-forward-on-clean-cars-and-trucks ↩︎

- https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after ↩︎

- https://www.enecho.meti.go.jp/en/category/special/article/detail_199.html ↩︎

- https://www.bloomberg.com/news/articles/2024-10-16/stellantis-shipments-drop-20-as-ceo-works-to-trim-inventories ↩︎

- https://www.wsj.com/business/autos/ford-motor-to-pause-f-150-lightning-production-for-several-weeks-54d20269 ↩︎

- https://www.bloomberg.com/news/articles/2024-10-15/bmw-ceo-says-eu-combustion-engine-ban-is-no-longer-realistic?sref=w410vTyp ↩︎

- https://www.theguardian.com/environment/2024/oct/04/carmakers-ramp-up-pressure-on-chancellor-for-ev-sales-subsidies ↩︎

- https://www.bbc.com/news/business-65643064 ↩︎

- https://www.ft.com/content/b95f9a64-c582-4367-9645-6a7106357849 ↩︎

- https://ec.europa.eu/commission/presscorner/detail/en/ip_24_3630 ↩︎

- https://www.hyundai.com/worldwide/en/newsroom/detail/pif-and-hyundai-motor-company-sign-joint-venture-agreement-to-establish-new-automotive-manufacturing-plant-in-saudi-arabia ↩︎

- https://www.linkedin.com/posts/jerrytoddjr_aepaesaedaeuaepaehaerabraewaepaesaetaezaewaerabraepaesaetaehaexaeuaeyaer-activity-7256624052977463298-5X7g?utm_source=share&utm_medium=member_desktop ↩︎

- https://gulfnews.com/world/gulf/saudi/30-of-cars-sold-in-saudi-arabia-bought-by-women-last-year-1.102477401 ↩︎

- https://www.arabnews.com/node/2540276/business-economy ↩︎

- https://www.ic.gov.sa/industries-automotive/ ↩︎